As we step into the vibrant bloom of spring, the property market in Reading, and nationally, shows promising signs of renewed vitality. With Rob Milne, our Managing Director, noting an "upturn in the number of new listings closely matched by the number of sales," WhiteKnights is at the forefront, witnessing firsthand the uptick in confidence among buyers and sellers alike.

A National Overview: Recovery in Motion

The first quarter of the year often starts slow but lays the groundwork for the bustling months ahead. In 2024, the UK market has demonstrated resilience, with sales agreed in Q1 increasing by 7% compared to the same period last year. This positive trend is encouraging more sellers to market their homes, leading to an 11% increase in listings. A key contributor to this buoyancy has been the dip in mortgage rates, now hovering around 4.4%, sparking a 9% hike in new sales and igniting seller optimism.

Reading's Market Echoes National Confidence

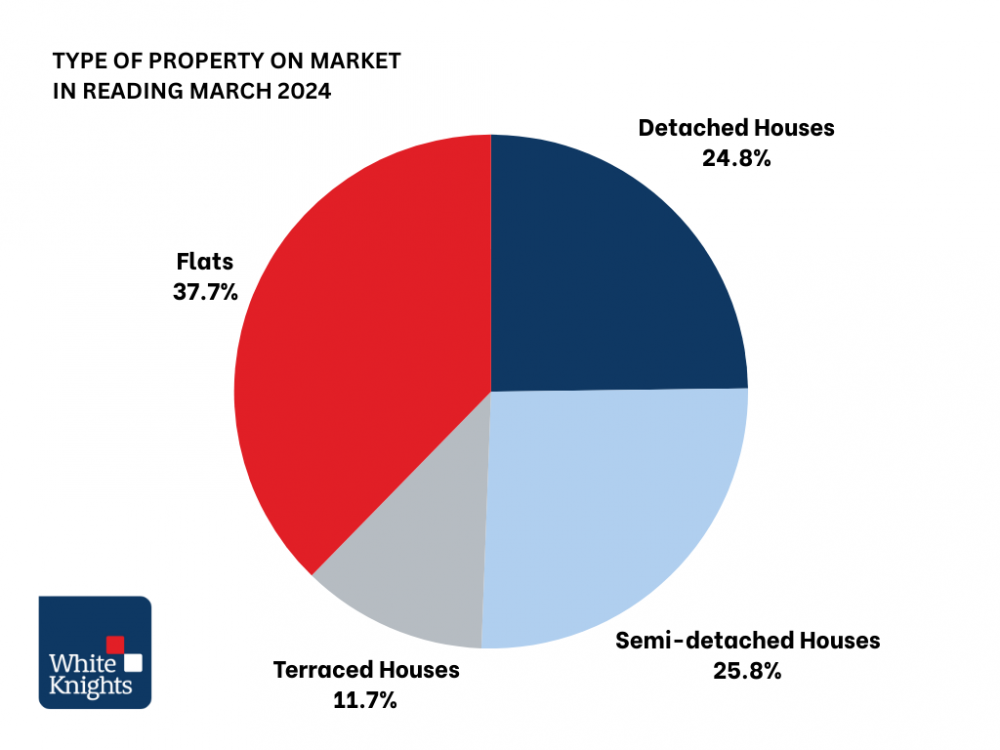

Reading's market statistics echo the national sentiment, with a robust collection of 1,258 properties for sale and an average property price standing proud at £469,391. Notably, the average time on the market for unsold properties has been reduced to a mere 123 days, indicating a faster-moving market that's responsive to buyer demand.

Properties in the £200,000 to £300,000 bracket appear to be the sweet spot in Reading, boasting the shortest average time on the market. And while the median price sits at a comfortable £399,725, it's the diversity in property types; from flats to detached homes; that offers something for every aspiring homeowner or investor.

Rob Milne Weighs In

"The first quarter of the year can often be slower transaction months as everyone gets back into the swing of a 'New Year'. However, we have definitely noticed an upturn in the number of new listings, closely matched by the number of sales achieved compared to the same period last year. This is a sign that buyers are feeling more confident about making a move to their next home during 2024," says Rob Milne, WhiteKnights' MD.

"April is now here, and this is often considered to be when the market fully comes alive, so if you are thinking of selling or buying a property in the Reading area, please get in touch, we would be delighted to discuss your moving plans."

What Does This Mean for Sellers and Buyers?

The alignment of increased sales and narrowing discounts from asking prices suggests a market that's finding its balance. With the average seller now accepting offers just £10,000 below the asking price, down from £14,250 in November, there's evidence of growing buyer confidence and seller realism.

For those considering selling, setting a realistic asking price is more crucial than ever to capitalise on the improving conditions. Buyers, meanwhile, are afforded greater choice, with nearly 30 homes on average available per estate agent, reflecting pre-pandemic numbers.

Looking Ahead: The Promise of Lower Interest Rates

The anticipation of lower interest rates in the latter half of the year could further invigorate the market. With household disposable incomes projected to increase by 3.5% over the year, and economists forecasting a base rate fall to 3.5% by the end of 2025, the outlook is optimistic for ongoing market buoyancy.

Your Next Move with WhiteKnights

As we observe the market spring back into action, WhiteKnights remains dedicated to navigating these promising trends for our clients. Whether you're considering buying or selling, our knowledgeable team is poised to guide you through the dynamic landscape of Reading's property market.

Connect with us today to embark on your property journey with confidence.

☎️ 0118 334 7410