Throughout our WhiteKnight offices in Reading we have been pleasantly surprised by the number of transactions taking place for both our sales and lettings teams. That said, there is clearly an adjustment in local prices, with properties for sale being marketed for less than previously this year, more price reductions taking place, and agreed prices reducing accordingly.

The other most notable point from our offices is that transactions are taking longer to get from agreement to exchange of contracts. Now, this could be due to holiday disruptions, of course, even solicitors and mortgage advisors deserve some time off, but it probably also has a lot to do with the financing situation with interest rate rises happening mid-transaction and a few more 'down-valuations' as mortgage companies adjust their survey figures in line with falling house prices.

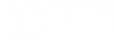

So let's take a look at what is on the market in Reading right now (source: home.co.uk):

- Total properties for sale in Reading: 1,438

-

Properties for sale in Reading listed in the last 14 days: 203

-

Average price of properties for sale in Reading: £451,073

-

Median price: £395,000

-

Average time on market (ToM) of unsold property in Reading: 139 days

-

Median time on market (ToM) of unsold property*: 64 days

When we look at the National picture, we have looked at the Zoopla House Price Index for August 2023. The heading of the report is that "house price rises are at their slowest rate since 2012" and our thoughts are that this is encouraging for so many people who had virtually given up on either being able to get onto the property ladder, or move up it! So let's take a look at the main points from the report:

-

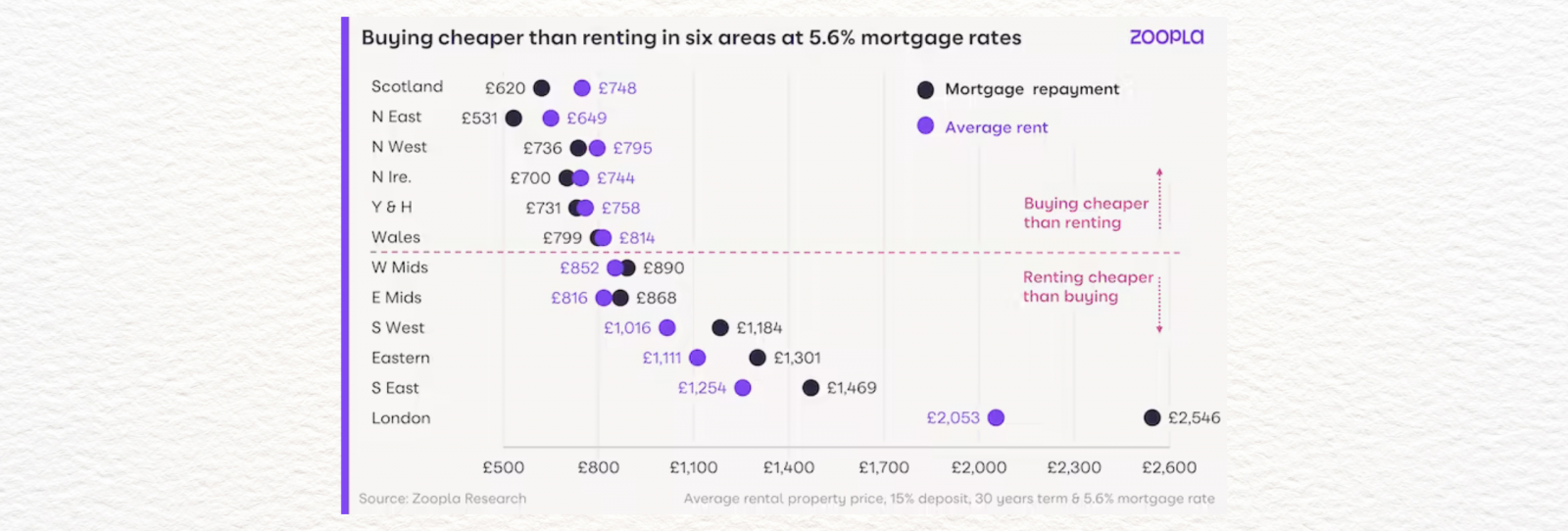

House prices in the UK have gone up by 0.1% in the last year, which is the slowest increase since 2012.

Prices have risen by 1.7% in Scotland and dropped by 1% in London.

-

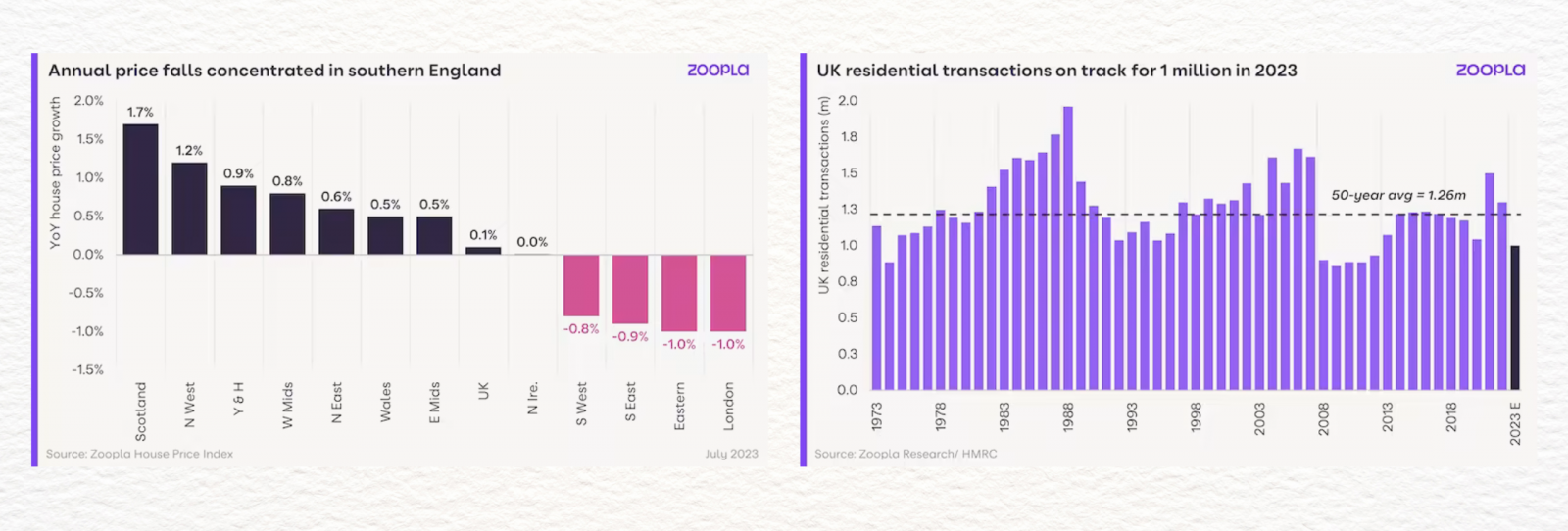

This year, there are 21% fewer property deals than in 2022.

-

Because rates are higher, mortgage-backed sales are expected to be 28% lower than last year, but cash sales won't be affected.

-

Higher wage growth is making homes more affordable. For the market to be more active in 2024, interest rates must go down.

-

Demand from buyers has been 34% lower in the last four weeks than it has been in the same time period over the last five years (2018–2022).

-

The number of houses that are "sold subject to contract" is 21% less than last year, but is still on track to finish 1 million residential property transactions by the end of 2023.

-

The number of sales offers to completions has dropped by 20%.

- By the end of the year, the house price to income % in the UK will be 6.3x. This makes buying a house about the same price as it has been over the last 20 years, on average.

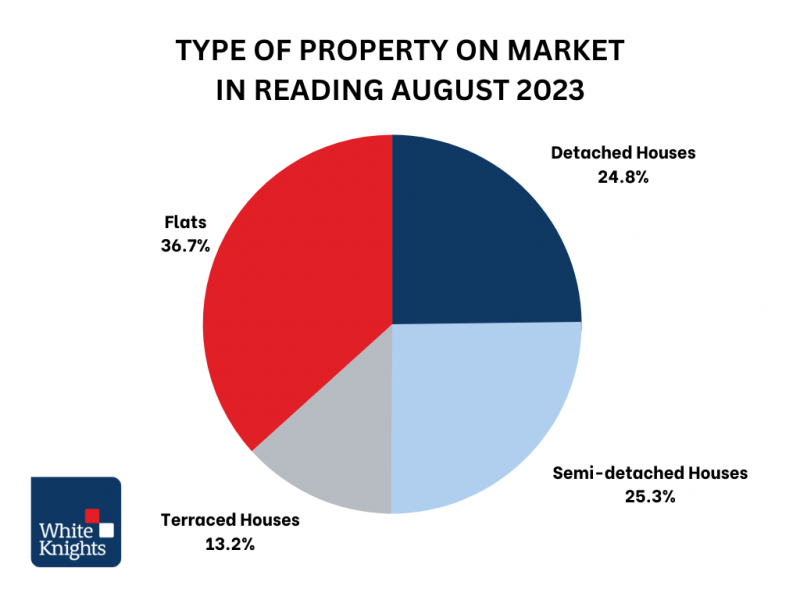

There is a clear north-south divide in house price inflation. In the last year, house prices have dropped by up to 1% in every part of the South of England. In all parts of South England, it costs more to buy a home than to rent one. The average monthly mortgage payment in London is 24% more than the average monthly rent. This is a big reason why house prices in the South of England will fall the most.

Higher mortgage rates also make it hard on people who rent out their homes. About 8% of all home sales in the UK are mortgaged buy-to-let deals. But buy-to-let buyers in South England now need 40–50% of the property's value in equity for the numbers to work.

The least affordable places to buy are in Southern England, where in many places you need a family income of more than £75,000 to be able to buy. The UK mortgage rates are 23% higher than they were last year, which means that the average mortgage payment is now £216 more each month.

Average wage increases of 7% over the past year are making homes more affordable, even though mortgage rates are going up. Since house prices are going down by a small amount, the gap between house prices and wages is getting smaller. In this way, affordability is likely to get better by 9–10% by 2023.

If you would like to discuss the property market with one of our experts, please get in touch with us:

T.0118 334 7410

E. firstcontact@whiteknights.co.uk